Tax incentives

Tax incentives are applied to donations to the TMUD Fund.

*Limited to donations made within Japan

*Limited to donations made within Japan

Individual donations

Deduction of income tax

Deduction of income tax for donations to general funds, purpose-specific funds (Fund for Promotion of Pre-emptive Medicine) and purpose-specific funds(Fund for supporting extracurricular activities):

◆ Income deduction

Individual donations to the TMDU Fund are entitled for tax benefit as designated donation eligible for deduction under the Income Tax Act (Article 78-2 (2)). Amounts in excess of 2,000 yen can be deducted from taxable income up to a maximum 40% of total income.

Please submit the TMDU Donation Receipt to the tax office when you file your final tax return for the year.

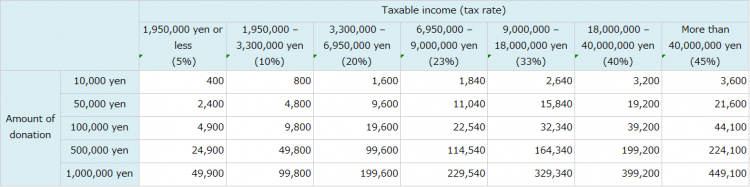

Calculation of tax refund based on income deduction

(Amount of donation – 2000 yen) x tax rate (depends on income level) = tax refund

Example: When a person whose annual taxable income is 7,000,000 yen donates 300,000 yen

(300,000 – 2,000) x 23% (tax rate) = 68,540 (tax refund)

* The amount of taxable income can be obtained by deducting all deduction and exemption items (including basic exemption, deduction for social insurance, exemption for spouse, exemption for dependents, deduction for life insurance, deduction for casualty insurance, etc.) from net employment income (employment income minus employment income exemption).

* Income tax rates are based on applicable laws as of April 1, 2016.

◆ Income deduction

Individual donations to the TMDU Fund are entitled for tax benefit as designated donation eligible for deduction under the Income Tax Act (Article 78-2 (2)). Amounts in excess of 2,000 yen can be deducted from taxable income up to a maximum 40% of total income.

Please submit the TMDU Donation Receipt to the tax office when you file your final tax return for the year.

Calculation of tax refund based on income deduction

(Amount of donation – 2000 yen) x tax rate (depends on income level) = tax refund

Example: When a person whose annual taxable income is 7,000,000 yen donates 300,000 yen

(300,000 – 2,000) x 23% (tax rate) = 68,540 (tax refund)

* The amount of taxable income can be obtained by deducting all deduction and exemption items (including basic exemption, deduction for social insurance, exemption for spouse, exemption for dependents, deduction for life insurance, deduction for casualty insurance, etc.) from net employment income (employment income minus employment income exemption).

* Income tax rates are based on applicable laws as of April 1, 2016.

Deduction of income tax for donations to purpose-specific fund (Fund for Supporting Students with Financial Difficulties)

Due to 2016 amendments to tax laws, a new option for tax exemptions other than the conventional income deduction is offered for donations to support students with financial difficulties. This applies to donations for TMDU Fund for Supporting Students with Financial Difficulties. Donors therefore can choose from either income deduction or tax exemption when filing their final tax return.

Please submit the TMDU Donation Receipt and a copy of the Tax Credit Certificate issued by TMDU to the tax office when you file your final tax return for the year.

◆ Income deduction (described above)

◆ Tax exemption

This is a system to directly deduct a certain percentage of the amount of donations made by individuals from the amount of income tax to be paid. This means that a certain amount can be deducted from income tax regardless of the income tax rate, making the tax-saving effect larger than income deduction for many people.

40% of the donated amount in excess of 2,000 yen (up to a maximum of 40% of total income) will be deducted from income tax.

Calculation of tax refund based on tax exemption

(Amount of donation – 2000 yen) x 40% = tax refund

Example: When a person whose annual taxable income is 7,000,000 yen donates 300,000 yen

(300,000 – 2,000) x 40% = 119,200 (tax refund):

* Tax exemption is allowed up to a maximum 25% of income tax.

* During the period from 2013 to 2037, special income tax for reconstruction (2.1%) will be added to the above described tax amount.

* Above figures are only a rough indication. Actual amounts may vary depending on type of income and various tax exemptions/deductions that may be applied.

Due to 2016 amendments to tax laws, a new option for tax exemptions other than the conventional income deduction is offered for donations to support students with financial difficulties. This applies to donations for TMDU Fund for Supporting Students with Financial Difficulties. Donors therefore can choose from either income deduction or tax exemption when filing their final tax return.

Please submit the TMDU Donation Receipt and a copy of the Tax Credit Certificate issued by TMDU to the tax office when you file your final tax return for the year.

◆ Income deduction (described above)

◆ Tax exemption

This is a system to directly deduct a certain percentage of the amount of donations made by individuals from the amount of income tax to be paid. This means that a certain amount can be deducted from income tax regardless of the income tax rate, making the tax-saving effect larger than income deduction for many people.

40% of the donated amount in excess of 2,000 yen (up to a maximum of 40% of total income) will be deducted from income tax.

Calculation of tax refund based on tax exemption

(Amount of donation – 2000 yen) x 40% = tax refund

Example: When a person whose annual taxable income is 7,000,000 yen donates 300,000 yen

(300,000 – 2,000) x 40% = 119,200 (tax refund):

* Tax exemption is allowed up to a maximum 25% of income tax.

* During the period from 2013 to 2037, special income tax for reconstruction (2.1%) will be added to the above described tax amount.

* Above figures are only a rough indication. Actual amounts may vary depending on type of income and various tax exemptions/deductions that may be applied.

Individual inhabitant tax deduction

Donors may be able to benefit from deduction of individual inhabitant tax for certain donations designated by prefectural or municipal ordinances.

Donation for TMDU Fund has been designated by Tokyo and Chiba (prefectural designation) as well as Bunkyo Ward and Ichikawa City (municipal designation).

* Individual inhabitant tax deduction will not be granted by other prefectures and municipalities (including Tokyo wards other than Bunkyo Ward).

* Individual inhabitant tax deduction is applied to donors whose address is in the prefectures/municipalities mentioned above on the first of January of the following year the donation was made.

Amount of individual inhabitant tax deduction = Total amount of donation made during the year (maximum of 30% of total income – 2,000 yen) x deduction rate

Deduction rate

Designation by prefectural ordinance: 4%

Designation by municipal ordinance: 6%

Designation by both prefectural and municipal ordinances: 10%

(Examples)

Inhabitants of Bunkyo Ward or Ichikawa City would receive a deduction of 10%.

Inhabitants of Tokyo (other than Bunkyo Ward) or Chiba (other than Ichikawa City) would receive a deduction of 4%.

Donation for TMDU Fund has been designated by Tokyo and Chiba (prefectural designation) as well as Bunkyo Ward and Ichikawa City (municipal designation).

* Individual inhabitant tax deduction will not be granted by other prefectures and municipalities (including Tokyo wards other than Bunkyo Ward).

* Individual inhabitant tax deduction is applied to donors whose address is in the prefectures/municipalities mentioned above on the first of January of the following year the donation was made.

Amount of individual inhabitant tax deduction = Total amount of donation made during the year (maximum of 30% of total income – 2,000 yen) x deduction rate

Deduction rate

Designation by prefectural ordinance: 4%

Designation by municipal ordinance: 6%

Designation by both prefectural and municipal ordinances: 10%

(Examples)

Inhabitants of Bunkyo Ward or Ichikawa City would receive a deduction of 10%.

Inhabitants of Tokyo (other than Bunkyo Ward) or Chiba (other than Ichikawa City) would receive a deduction of 4%.

Inheritance tax exemption

If a donor donates his or her inherited property to TMDU and meets certain requirements, he or she does not need to pay inheritance tax for the donated property. Please consult TMDU Donations Office well in advance of the due date for filing inheritance tax returns.

Inquiries: TMDU Donations Office

Address: 1-5-45 Yushima, Bunkyo-ku Tokyo 113-8510, JAPAN

e-mail: bokin.adm (insert @ here)tmd.ac.jp

Inquiries: TMDU Donations Office

Address: 1-5-45 Yushima, Bunkyo-ku Tokyo 113-8510, JAPAN

e-mail: bokin.adm (insert @ here)tmd.ac.jp

Corporate donations

Corporate donations to the TMDU Fund are entitled to tax benefit as designated donation eligible for inclusion of full amount in deductible expenses under the Corporation Tax Act (Article 37-3 (2)).